TAXLITIGATOR Blog

Wishing our Longtime Legal Assistant JULIE TAKEMOTO a Happy Retirement!

It is with mixed emotions that we announce the retirement of our longtime legal assistant, Julie Takemoto. Julie has been a part of the Hochman Salkin family since 1981 and has helped shape the firm into what it is today. Her hard work and dedication to others is a reflection of the culture and success […] Read More…

Read MoreDENNIS PEREZ to speak at the upcoming Oregon Tax Institute entitled “Current IRS Enforcement Objectives, Ways in which IRS Detects and Pursues these Objectives and Taxpayer Defense Alternatives,” Multnomah Athletic Club, Portland, Oregon

We are pleased to announce that Dennis Perez will be presenting at the upcoming Oregon Tax Institute, June 6-7, 2019. From important court decisions to the Tax Cuts and Jobs Act(“TCJA”), the 2019 Oregon Tax Institute will cover a range of state and federal tax topics to help ensure practitioners are best situated to advise […] Read More…

Read MoreSTEVEN TOSCHER and DENNIS PEREZ to speak at the upcoming NYU 11th Annual Tax Controversy Forum

We are pleased to announce that two of our principals will be speaking at the upcoming 11th Annual Tax Controversy Forum at Crowne Plaza Times Square, Manhattan, New York on June 20 and 21. For more information Click Here. Steven Toscher will be speaking on Litigating Foreign Asset Reporting Tax Penalties: The Controversies Continue. It’s […] Read More…

Read MoreA District Court Enforces a John Doe Summons Issued to a Law Firm (Prefaced by a Brief Primer on John Doe Summonses) by ROBERT S. HORWITZ

Administrative summonses are an important investigative tool of the IRS in fulfilling its statutory duty of “proceeding from time to time, through each internal revenue district and inquire after and concerning all persons who may be liable to pay any internal revenue tax.” Internal Revenue Code (“IRC”) §7601(a). Where a person served a summons fails […] Read More…

Read MoreTax Court Holds IRS Can Assess, Collect Restitution Notwithstanding District Court Payment Schedule by ROBERT S. HORWITZ

In 2010, Congress amended Internal Revenue Code (IRC) sec. 6201 by adding subsection (a)(4), which authorizes the IRS to assess and collect the amount of criminal restitution ordered for failure to pay any tax in the same manner as if the restitution was a tax. The assessment could be made at any time after all […] Read More…

Read MoreFinCEN Amps Up Virtual Currency Regulation and Warns About Misuse of VC by EVAN DAVIS

The government continues to show its presence regulating virtual currency and enforcing civil and criminal laws in this developing area. Our Firm has had a number of clients involved in civil tax and criminal (tax, securities, and Bank Secrecy Act (“BSA”)) investigations, and the Government continues to show its active presence. FinCEN (Financial Crimes Enforcement […] Read More…

Read MoreHOCHMAN SALKIN TOSCHER PEREZ P.C. Proud Sponsor of the CalCPA 7th ANNUAL 5K BEACH RUN AND WALK

Join CalCPA and the Sean Brock Foundation in a charity run which will include a 5K run and walk, 10K run and a 1K(ish) kids run. You’ll enjoy the scenic water views along Dockweiler State Park while giving back to a worthwhile cause. So, get your teams ready for some friendly competition and help raise scholarships […] Read More…

Read MoreTax Notes -Now I Am a C Corp: What About the Accumulated Earnings Tax? by CORY STIGILE

In this article, Cory Stigile provides background on the accumulated earnings tax and explains the steps corporate taxpayers may be able to take if the government begins to more actively audit and litigate the accumulation of profits. The Tax Cuts and Jobs Act reduced the corporate tax rate from 35 percent to 21 percent, providing […] Read More…

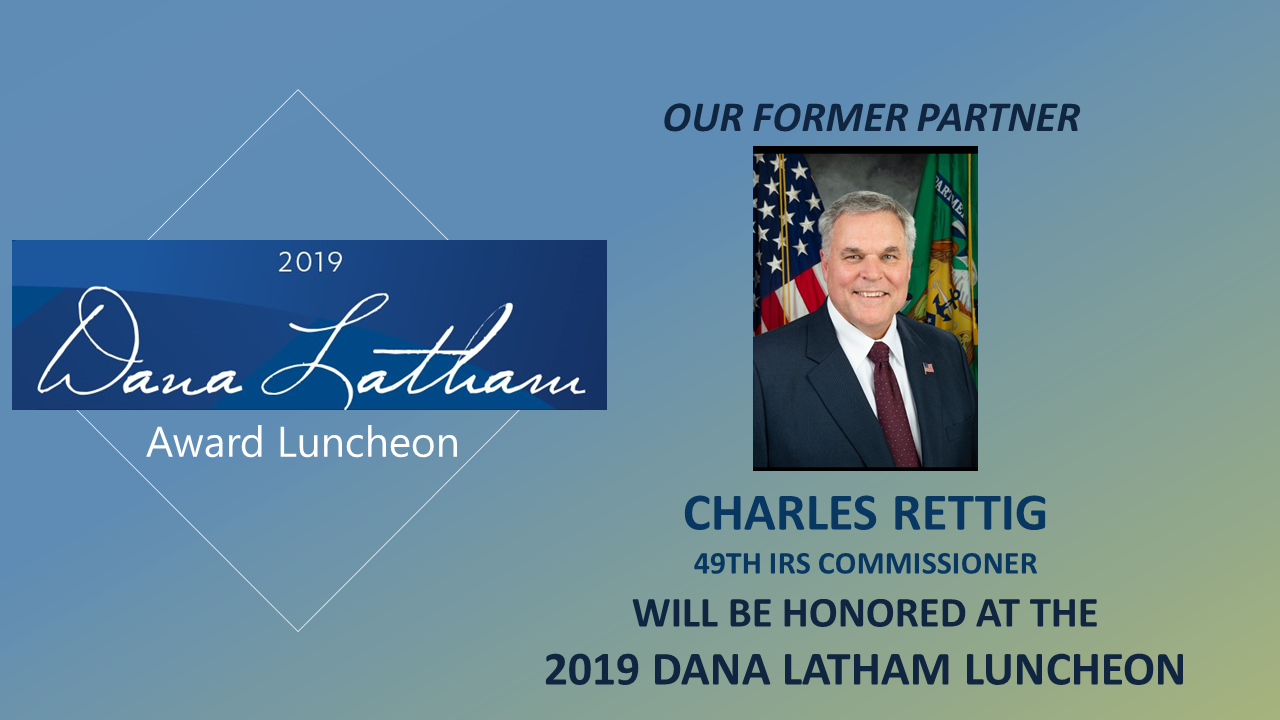

Read MoreCHARLES RETTIG, 49th IRS Commissioner to be Honored at the 2019 Dana Latham Luncheon

Please join us when our former partner Charles P. Rettig, 49th Commissioner of the Internal Revenue Service, will be honored at the 2019 Dana Latham Luncheon on June 7th at 11:30 a.m. – 1:30 p.m. at the Omni Los Angeles Hotel, Los Angeles. The Taxation Section will also be honoring James D.C. Barrall, Senior […] Read More…

Read MoreTax Court Holds IRS Can Assess, Collect Restitution Notwithstanding District Court Payment Schedule by ROBERT S. HORWITZ

In 2010, Congress amended Internal Revenue Code (IRC) sec. 6201 by adding subsection (a)(4), which authorizes the IRS to assess and collect the amount of criminal restitution ordered for failure to pay any tax in the same manner as if the restitution was a tax. The assessment could be made at any time after all […] Read More…

Read MoreSTEVEN TOSCHER, JONATHAN KALINSKI and ROBERT HORWITZ to speak at the upcoming ABA Annual May Meeting entitled “Collection-Based Tax Crimes” Grand Hyatt, Washington D.C.

We are pleased to announce that three of our principals will be speaking at the upcoming May Tax Section meeting in Washington, D.C. on May 9th through the 11th. Steven Toscher and Jonathan Kalinski will be speaking on Collection Based Tax Crimes. Over the last few years, the Internal Revenue Service Criminal Investigation Division and the Department of Justice […] Read More…

Read MoreSTEVEN TOSCHER appointed Law360 Tax Authority Federal Editorial Advisory Board

We are pleased to announce that STEVEN TOSCHER has been appointed to the Law360 Tax Authority Federal Editorial Advisory Board. The purpose of the editorial advisory board is to get feedback on Law360’s coverage and gain insight from experts in the field on how best to shape future coverage.

Read More